Report from the US Meat Export Federation, KyCorn’s red meat trade partner

Demand for high-quality red meat from the U.S. remained strong in the first quarter of 2020, despite CoVID-19-related disruptions in export markets. Through March, U.S. exports of both pork and beef were on a record pace and accounted for a growing share of U.S. production, even with record production levels. However, supply chain disruptions in the U.S. are expected to slow exports in April and May. USMEF forecasts record levels of exports for U.S. beef and pork in 2020, based on global supply and demand fundamentals.

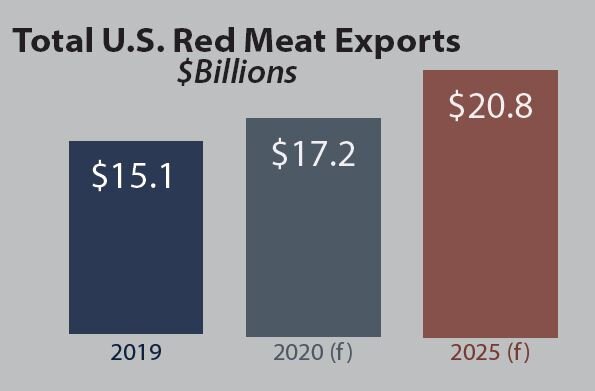

USMEF forecasts that U.S. red meat exports will increase 14% in value in 2020

Trade agreements with Japan and China fueled export growth for U.S. red meat in early 2020. On the supply side, analysts are forecasting a significant drop in global pork production in 2020 due to ASF in China and in Southeast Asia, while Australia’s beef production and exports are expected to decrease by double-digits.

Supply & Demand = Opportunity

Exports maximize carcass value by capitalizing on demand for underutilized variety meats in international markets. For example, beef tongue exports bring a premium in Japan, beef tripe is popular in Mexican cuisine and China is a major market for pork feet. These export sales add up:

Total U.S. beef and pork variety meat exports in 2019 = $2 billion

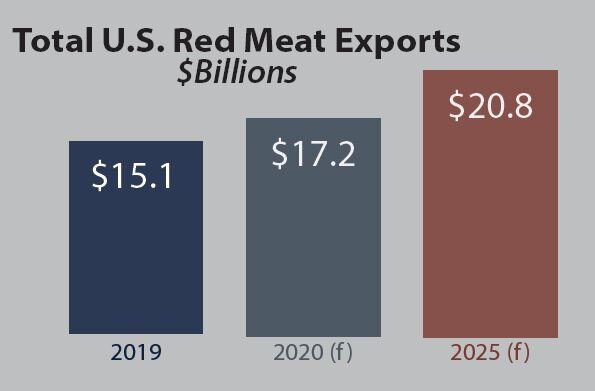

Production is declining and demand is growing in major import markets, while new markets are emerging for red meat in Southeast Asia and Central and South America. China alone is expected to import nearly 5 million metric tons of pork/pork variety meats from all suppliers in 2020. Our trading partners in the Asia Pacific region rely on imports to meet growing red meat demand:

Around the world, the growth in the middle class and increased urbanization have been underpinning demand for high-quality red meat from the U.S., enabling record exports in recent years. Although CoVID-19 has slowed foodservice and tourism around the world, the longer-term market dynamics suggest sustained demand from the U.S. as a top global supplier of red meat.

USMEF’s Market Development Strategy

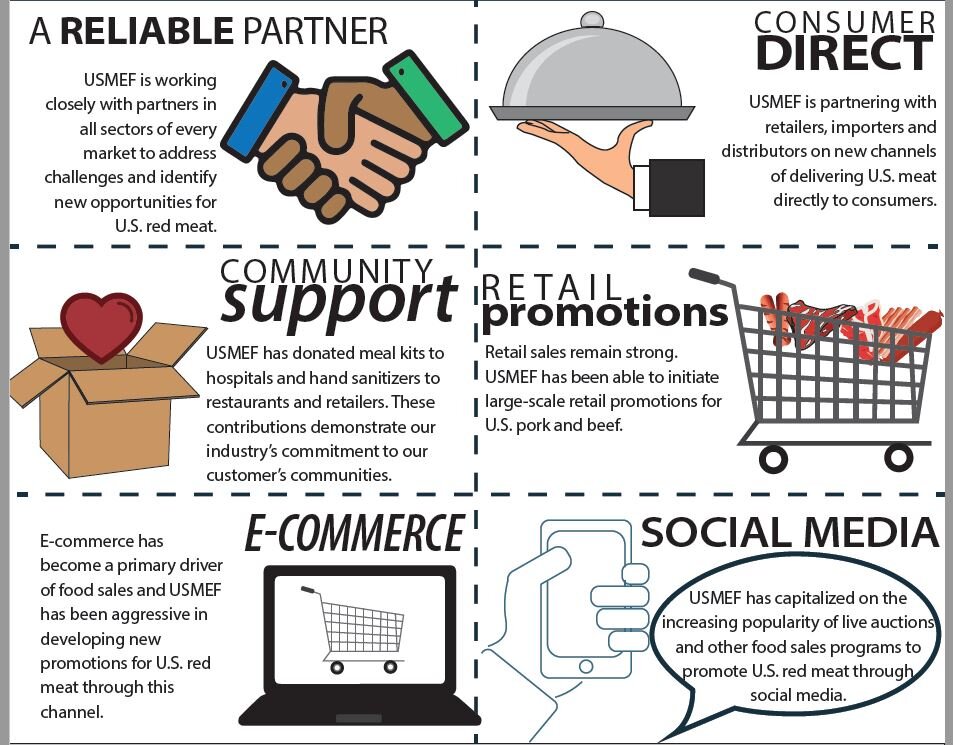

Market conditions in the first four months of 2020 have called for flexibility and innovation. The overall shift in food sales and distribution from foodservice to retail has created significant challenges for foodservice sectors and new opportunities in retail sectors.

USMEF is working with partners in areas such as e-commerce, delivery, social media and improved planning and coordination of their online and offline activities related to U.S. red meat. Traditional retail promotions remain effective at pulling U.S. meat through the chain.

Building Partnerships at Home & Around the World

USMEF is the most vertically integrated trade association in the U.S. meat and livestock industry. USMEF represents beef/veal producers and feeders, pork producers and feeders, lamb producers and feeders, packers and processors, purveyors and traders, oilseeds producers, feedgrains producers, farm organizations and supply and service organizations.

In 2019, red meat exports accounted for 14.1% of U.S. beef and variety meat production and 26.9% of U.S. pork and variety meat production.

According to a study conducted by WPI, Inc. for USMEF, in 2018, red meat exports accounted for:

-

459.7 million bushels of corn utilization, with a market value of $1.62 billion at the year-average market price 2 million tons of DDGS utilization, with a market value of $291 million at the year-average market price

-

84.2 million bushels of soybean disappearance, with a market value of $738 million at the year-average price