By Will Snell, University of Kentucky Agriculture Economics

Economic and Policy Update

The farm economy entered 2020 amidst a prolonged period of depressed commodity prices with incomes of some Kentucky farmers aided in recent years by a combination of relatively high crop yields, government assistance through the Market Facilitation Program (MFP) payments, and growing meat export markets. In reality, the industry was hoping to experience a “demand” shock in 2020 following ratification of the United States-Mexico-Canada Agreement (USMCA) a Phase I deal with China, and trade discussions with other markets like the United Kingdom and the European Union to counteract the excess supplies of meats and crop inventories as a means to boost prices and income in the coming year.

Well a “demand” shock has actually occurred and it has not been expanded trade, but in the form of a massive loss in consumer buying power, i.e., income. Most economists agree that the United States has entered a recession during the second quarter of 2020, while the International Monetary Fund (IMF) forecasts that the global economy will contract 3% in 2020. As we reported in last month’s issue of this newsletter, typically agriculture is partially shielded from economic downturns as the aggregate demand for food in prosperous nations is generally not very responsive to changes in income. While the demand for some foods like beef and seafood tend to be more responsive to income changes, total food consumption doesn’t change much in an economic downturn compared to other vulnerable sectors of the economy like travel, entertainment, housing, and manufacturing.

U.S. Food Expenditures

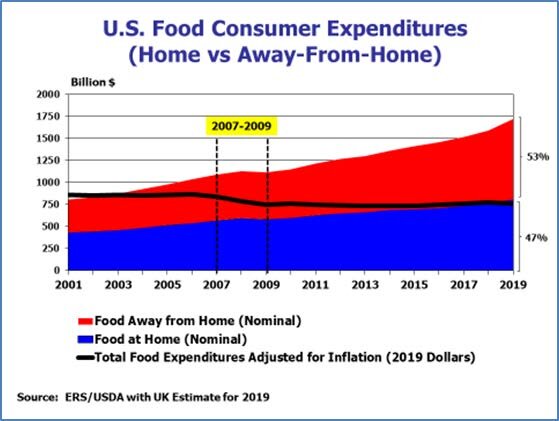

Looking back at the Great Recession, which officially ran from December 2007 to June 2009, total U.S. consumer food expenditures actually increased nearly 3% during the 2007-2009 time frame. Full service restaurant sales did fall 2%, but limited service restaurant sales actually increased 5%, with grocery sales up 3%. Adjusting for inflation, real food expenditures declined 4.2% from 2007 to 2009, with full-service restaurant sales off 9.2% compared to a loss of grocery sales of 3.7%. According to USDA, inflation-adjusted food spending by U.S. households did not fully recover from the Great Recession until 2015. Growing personal incomes led to increased restaurant expenditures, with 2015 representing the first time in history that U.S. food sales away from home exceeded U.S. food sales purchased for home consumption. Higher food sales away from home continued to surpass food sales at home through 2019. However, we will see some abrupt changes in that trend for 2020 with restaurant sales down record levels in March and April following government actions to close many establishments across the nation.

Plus, most analysts predict that future restaurant traffic will continue to linger even once the U.S. economy is reopened. The National Restaurant Association told Congress that the industry laid off 2/3 of their workforce in March and April and is expected to lose $240 billion in sales (around 15% of total U.S. food sales) in 2020. Expanded grocery sales and employment should help offset some of these losses, but total U.S. food expenditures will likely be impacted much more in 2020 than what the nation experienced during the Great Recession due to a variety of reasons.

First, the U.S. economy is experiencing a much greater demand shock compared to economic adjustments encountered during the Great Recession. In addition, the food sector is plagued with supply disruptions along the food chain with processing facilities closing temporarily due to the virus, challenges of redirecting food distribution away from restaurants to grocery stores, labor challenges across the food production and marketing system, transportation bottlenecks, food export restrictions abroad, and a much greater number of unemployed consumers who are closely monitoring food expenditures amidst depleted personal incomes. While some of these marketing issues may be resolved in the weeks to come, concern remains about some of the longer term effects this pandemic has exposed on the food supply chain.

U.S. Food Prices

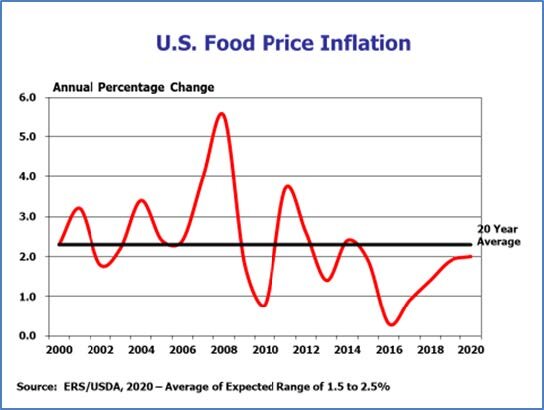

Another major difference between today’s food economy versus the 2007-2009 period is the level of food price inflation. During the Great Recession, food price inflation was at its highest level in over 20 years, peaking at 5.5% in 2008 and averaging nearly 4% annually during the period. Increased demand via panic buying and limited supplies initially did lead to a boost in retail prices for some food items (eggs, some meats) during the early weeks of COVID-19, but recent data reveal that overall food price inflation remains rather benign given ample food supplies. According to the USDA Food Price Outlook Report for April 2020, U.S. food prices increased 0.3% in March 2020 compared to the previous month, with overall food prices up only 1.4% for the year. For 2020, USDA is projecting that food prices will increase 1.5 to 2.5% (0.5 to 1.5% for at home food purchases), compared to a 1.9% increase in food prices in 2019 and a 20 year annual food price inflation rate of 2.3%. It is important to point out though, that unintended processing plant closures and further supply disruptions could alter future price forecasts.

Price and Income Effects on the Farm Economy

Prior to the escalation of the coronavirus crisis in America, USDA projected U.S. net farm income would increase 3.3% (to $96.7 billion) in 2020 as projected modest farm price increases, higher quantities, and adjustments to net inventories would more than offset lower anticipated government farm payments. Assessing the effects of COVID-19 on the farm economy, earlier this month, the Food and Policy Research Institute (FAPRI) predicted U.S. net farm income to total $86 billion in 2020, down 11% from USDA’s February estimate and 19% ($20 billion) below FAPRI’s January estimate. These estimates did not include any government assistance dollars that are part of the Trump administration economic stimulus package (see below).

The severe economic downturn, disruptions in the food supply chain, and continued trade uncertainty evolving from the Coronavirus have led to significant downward pressure on already depressed ag commodity prices. Based on price forecasts for the remainder of the year, our department is currently estimating that Kentucky ag cash receipts could fall back to $5.4 – $5.7 billion after several years of approaching $6 billion. Consequently, like the past couple of years, net farm income for 2020 will once again be very dependent on the level of government farm payments.

In response to COVID-19, Congress allocated an immediate $9.5 billion as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act to support agriculture, plus an additional $14 billion to become available on July 1st to replenish a depleted Commodity Credit Corporation (CCC) which is responsible for providing federal funding for various farm programs. On April 17th USDA announced a $19 billion Coronavirus Food Assistance Program (CFAP) to provide financial relief to the ag sector induced by COVID-19. Specifics on eligibility, payment rates/calculations and implementation of the package remain unknown as USDA continues with the rulemaking process to spell out the program details. The American Farm Bureau Federation (AFBF) offers the following details related to their understanding of CFAP:

Direct Payments to Producers ($16 billion)

-

Calculations will be based on 85% of the price decline from January to April plus 30% of the expected losses during the two quarters after mid-April.

-

To qualify for a payment, a commodity must have experienced a price decline of at least 5% between January and April.

-

$9.6 billion is reportedly dedicated to the livestock industry ($5.1 billion for cattle, $2.9 billion for dairy, $1.6 billion for hogs), $3.9 billion for row crops, $2.1 billion for specialty crops and $500 million for other crops, but USDA maintains flexibility in adjusting these levels.

-

Direct payments to farmers under the CARES Act will be limited to a maximum of $125,000 per commodity with an overall limit of $250,000 per individual or entity, which will exclude other farm program payments.

Product Purchases ($3 billion)

-

Food product purchases including fresh fruit, vegetables, produce, dairy and meat for distribution. For more details click here.

Currently USDA is getting a lot of recommendations and feedback on this package, including the April date to determine price losses, payment limitations, contractual versus ownership marketing losses, and the appropriate price series. So stay tuned for the official details which are likely to be released soon given USDA’s desires to have these payments delivered by late May or early June.

Despite these funds, the current outlook for the 2020 ag economy is bleak with more comparisons to the early 1980s certainly to be debated as this current crisis unfolds. Consequently, members of Congress and others are pleading for additional funding to ward off a potentially devastating impact on the farm economy plus other groups are requesting support for the ethanol sector (which was not part of the CARES Act) and expanded Supplemental Nutrition Assistance Program (SNAP) funding.

The April issue of the Economic and Policy Update contains additional articles related to COVID-19 and government programs to help farmers.