By Todd Davis

Assistant Extension Professor

Grain Marketing and Risk Management, UK Department of Agricultural Economics

Story featured in the February 2020 Economic and Policy Update

The projected prices for revenue protection (RP) insurance for corn and soybeans are currently being determined. RP insurance initial price guarantee is the average of the closing prices for the December and November futures contracts for corn and soybeans, respectively, in February. As of February 20,2020, the average prices are $3.92 and $9.20 for corn and soybeans. If realized, the RP guarantees for corn and soybeans would be $0.08/bushel and $0.34/bushel lower than last year’s guarantee.

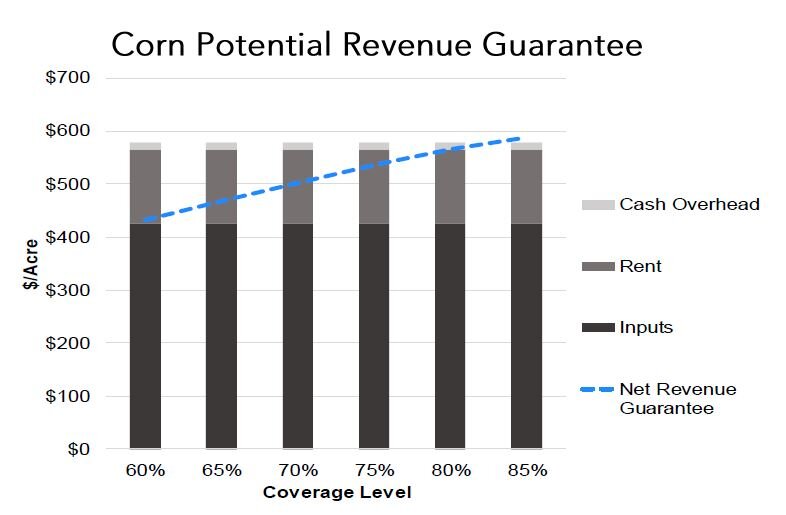

Figure 1: Example 2020 Revenue Projection Protection for Corn Compared to Budgeted Cash Costs for a 185-bushels APH Yield.

Figure 1 illustrates the potential revenue guarantee from crop insurance, net of the producer paid insurance premium, compared to the corn crop’s budgeted cash costs. In this example, inputs are budgeted at $426 per acre, and cash rent is budgeted at $185/acre assuming 75% of the land base is rented for a per acre cash cost of $139/acre. This assumption is from the Kentucky Farm Business Management (KFBM) reports that show the average grain farm owns 25% of the farm’s tillable acres. Cash overhead costs are budgeted at $14/acre for total cash costs of $579/acre (Figure 1). Managers should remember that the budgets do not include the family living expenses covered by the crop farm. Similarly, the budgets do not provide a return for machinery replacement and may not accurately reflect the annual principal and interest due on intermediate or long-term debt.

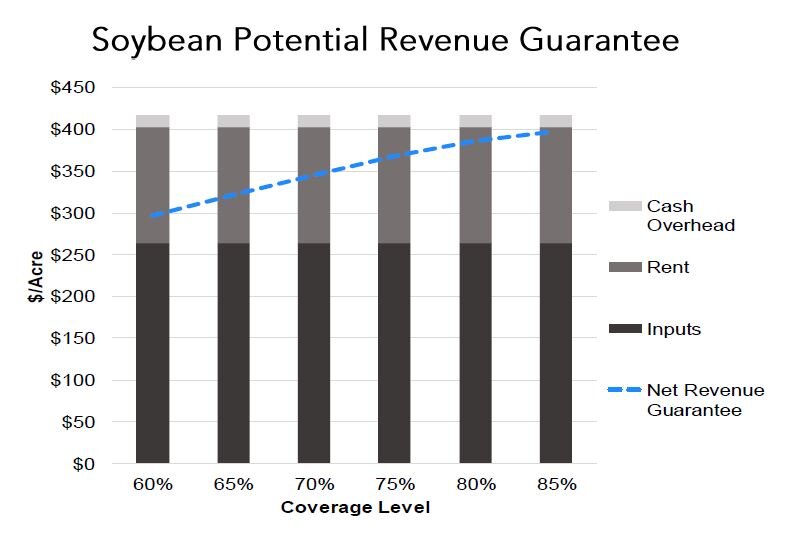

The APH yields in the examples are 185-bushels for corn and 55-bushels for soybeans which are Olympic Average yields for the KFBM farms in the Ohio Valley region. For corn, RP insurance at the 70% level has a deficit from total budgeted cash costs of $76/acre, while the 80% coverage level has a deficit of $14/acre. The 85% coverage level may cover total budgeted cash costs and would provide the greatest liquidity protection for corn.

Figure 2 illustrates the risk protection provided by RP insurance for soybeans. Total cash inputs are budgeted at $264/acre, cash rent of $185/acre paid on 75% of the land base is budgeted at $139/acre, and the cash overhead costs are budgeted at $14/acre for total cash costs of $417/acre. RP insurance at the 70% coverage level has a deficit of $71/acre below budgeted cash costs. The deficit at the 85% coverage level is $18/acre.

Figure 2: Example 2020 Revenue Projection Protection for Soybeans Compared to Budgeted Cash Costs for a 55-bushel APH Yield.

The best RP coverage level depends on the farm’s working capital availability and the manager’s risk tolerance towards cash loss. The amount of working capital is the farm’s financial safety reserve used to mitigate the effect of lower prices and/or yields. Managers that are liquidity constrained may want to consider how increasing their RP insurance coverage level can help limit revenue risk and the impact on cash flow. Similarly, managers that are more risk-averse may prefer the higher coverage level. Managers should continue to preserve working capital as tight profit margins are projected for 2020 corn and soybean crops.